MoneyWorks Manual

Automatic Entry from the Transaction File

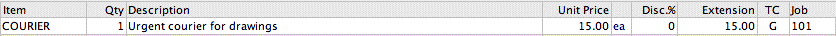

When the Enable Job Costing and Time Billing Job preference item is set, details from each transaction detail line that is tagged to a job will be automatically transferred to the Job Sheet list when the transaction is posted., e.g. the line:

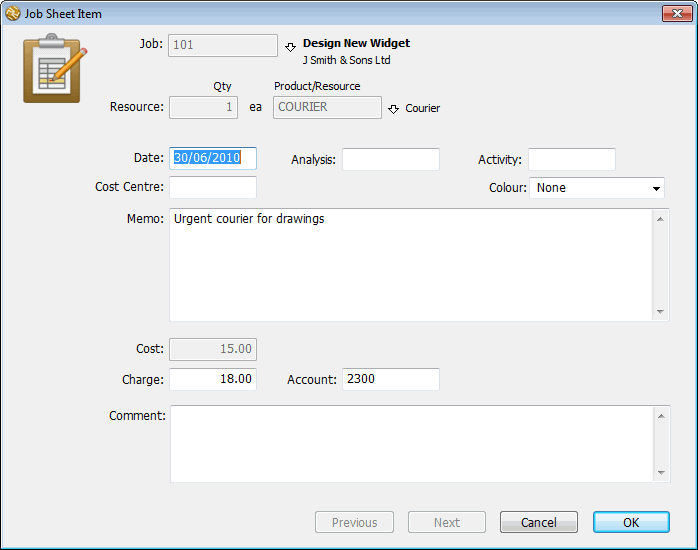

when posted creates the following Job Sheet Entry:

Entries that are automatically created from a transaction in this manner should not normally be altered or deleted—this is signified by the display of a padlock in the right hand column of the Job Sheet Items list. The following is transferred:

| Transaction Record | Job Sheet Entry |

|---|---|

| Transaction.TransDate | Date |

| Detail.JobCode | Job |

| Detail.Qty | Qty |

| Detail.StockCode | Resource |

| Detail.Unit | Unit |

| Detail.Description | Memo |

| The department suffix from the detail. account (if any) | Cost Centre |

| Transaction.Analysis | Analysis |

| Detail.AccountCode | Account |

The Cost will always be the current standard cost of the item. The Charge will vary according to the Job Pricing settings in the product .

Transferring from service transactions: It is mandatory to specify a product in the Job Sheet Entry file. However in a service transaction no product information is given. When the detail line from a service transaction is transferred, MoneyWorks will give it a product code “JOB_MISC”, and a quantity of 0.

If the product JOB_MISC does not exist, it will be automatically created. The cost of the item will be taken from the transaction detail line, and the standard markup for the job (or the default markup if the job is on a quotation basis) will be used to determine the charge price for the job.

If you want to use a different pricing regime for these items, you should create the JOB_MISC product yourself, and set its job pricing as desired.

You can enforce the entry of a job code in a service transaction by setting the Job Code Required option in the Accounts entry screen.

Transferring from transactions involving inventory: If you tag a transaction detail line that refers to a stocked product, the inventory levels for the item on the detail line will not be affected. If the item is purchased, it is assumed that it is being purchased specifically for the job, so the item’s cost of goods account is debited instead of the stock account1; if it is being sold, it is assumed that the item has already been requisitioned from stock through the job sheet items, so the income account for the job is credited instead of the stock account. But see Stock Requisitions for the exception to this.

Transferring from Income Transactions: Normally tagged income detail lines will be transferred as processed job sheet items, on the assumption that the work has already been done for the job. This is what normally happens when you post an invoice created by the Bill Job command. However if, for example, a deposit has been prepaid on a job, this may not be true. Income detail lines can be transferred as pending job sheet items if the preference option Treat Job Related Income as Pre-Payments is set. This allows you to offset previous income against work done.

1 You can transfer this to work-in-progress by using the Work-in-Progress Journal command. ↩