MoneyWorks Manual

Recording Disbursements

Thus far we have seen how to enter time and stock requisitions. However jobs also can attract expenses (disbursements), and if these are tracked they can be recovered from the client. Helen had to drive 50 kilometres on a site visit. Acme Widgets charge travel at a flat rate of 54 cents per kilometre.

- Create a new job sheet entry by pressing Ctrl-N/⌘-N

- In the Job field type “100”

- In the Qty field type “50”, and in the Product/Resource type “KM”

- In the Memo type “Travel to Widget Farm”, then press OK

In situations such as this, it is appropriate to enter the expense record directly into the job sheet items. Other examples of this might be for photocopy recovery, tolls and so forth. However in many cases the company will be directly charged for the expense.

As a part of the job, Acme Widgets commissioned some consultants to investigate the planning aspects of the refurbishment. This charge against the job can be recorded directly against the job when the invoice from the consultants is processed in the normal Creditor transaction system of MoneyWorks.

- Create a new transaction by pressing Ctrl-Shift-N/option-⌘-N

A new transaction entry window will be displayed.

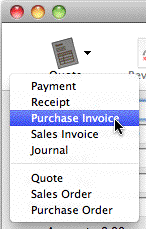

- Set the transaction type to Purchase Invoice and set its type to By Account (if necessary)

- In the Creditor field type “BSUPP”

This is the code for the consultant concerned.

- In the Amount field type 4500

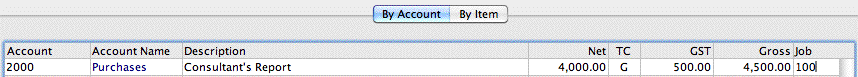

- Type “2000” as the Account code in the detail line1

- Type “Consultant’s Report” in the description

To associate an expense with a job you must specify the job code in the job column.

- Tab to the Job column and type “100”

The line should be as follows:

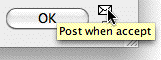

- Click on the posting icon so the transaction will be posted, then click OK

When a transaction is posted, the information in any of the detail lines that contains a job code is automatically transferred to the Job Sheet Items file so it can be billed out.

- Press Ctrl-5/⌘-5 to show the Job Sheet Items list

You will see a new entry with a product code of Job-Misc in the list. This was automatically created when the originating accounting transaction was posted. Note that the amount to charge has been automatically increased by the job markup percentage.

1 You would probably have a special code called “Consultants Employed” or some such thing. The demo file doesn’t have one of these, so we’ll just use the Purchases account. ↩