MoneyWorks Manual

Setting up Customer Accounting

You will need to do some additional setup to handle customer accounting.

New Tax Codes

If your MoneyWorks file was created prior to 8.1.4 and you are required to use Customer Accounting, you will need to create some new GST codes (these will be created automatically in new files made using version 8.1.4 or later). See Tax Codes for information on creating these.

The new codes are:

| Code | Details | Rate | IRAS Code |

|---|---|---|---|

| GPG | Sale of Prescribed Items | 0% | SRCA-S |

| CAG | Prescribed Items for Customer Accounting | 7% | TXCA |

| CAA | Purchase GST on Prescribed Items | 100% | SRCA-C |

Note: Code CAA must have the All Tax option set.

Note: Do not use the IRAS codes shown in the above table (they are for information only). Provided that you use the above coding structure shown, MoneyWorks will substitute the IRAS codes when preparing the IRAS F5 and IAF reports.

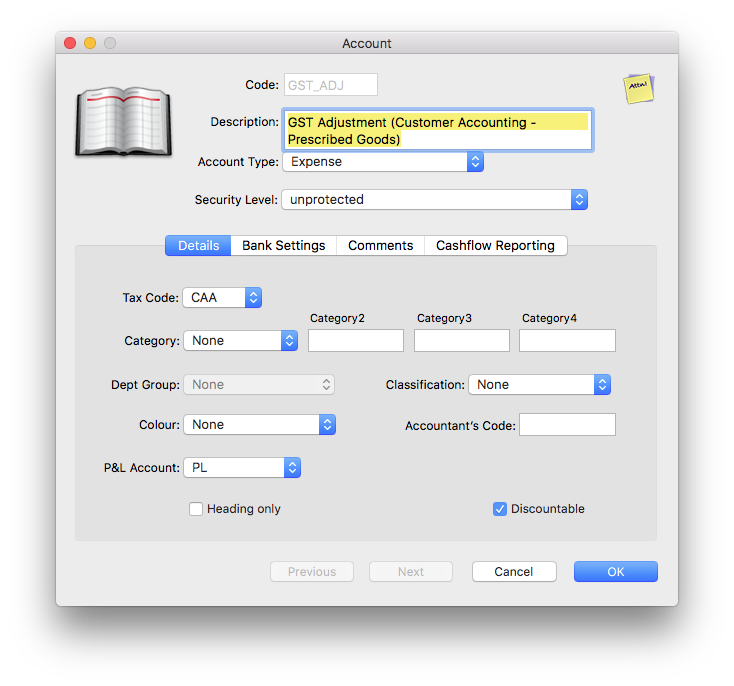

New General Ledger Code

You will also need to create a new general ledger expense code to handle the special accounting required (this code is not included in the default account setup as it will only be applicable to a small number of users). The account should be called something like "GST Adjustment (Customer Accounting - Prescribed Goods)", and have a tax code of "CAA" as shown below.

For information on creating account (general ledger) codes see Creating a New Account.

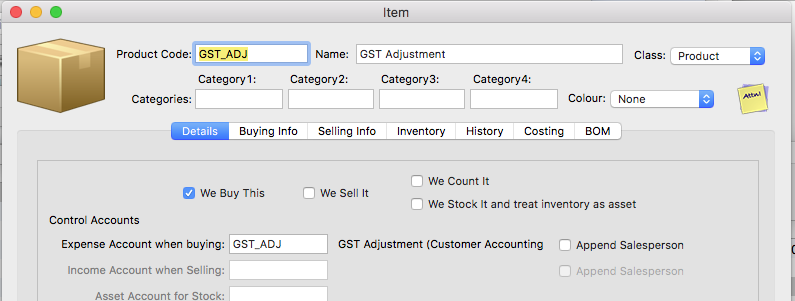

New Item

If you are purchasing prescribed goods as items (as opposed to "By Account"), you will need a new Item to handle the customer accounting calculation. This will be an item that your purchase (you won't sell it), and it will have the Expense account when buying account set to the GL account created above (i.e. one with a tax code of "CAA"), as shown below:

For information on creating a new item see Creating a New Item.