MoneyWorks Manual

Tax Codes

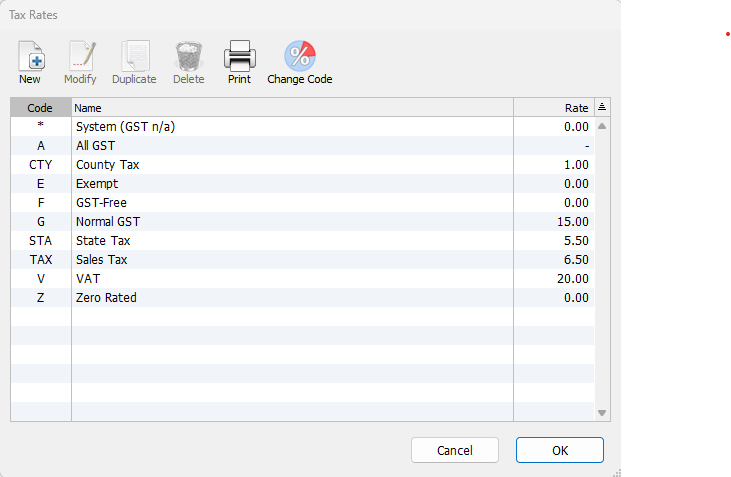

MoneyWorks has a built-in table of tax codes and rates. These tax codes are associated with Accounts or Names, and the corresponding rate is used to calculate the GST or sales tax whenever a transaction is entered. You can modify the standard codes (except *) if you wish, or add new codes for special situations (e.g. special rates for rest homes, out of state sales, beverage and accommodation taxes etc). The default tax codes are:

| Default Codes (most countries, not USA) | ||

| E | GST/VAT exempt [not Australia] | 0% |

| Z | Zero-rated items [not Australia]. | 0% |

| A | 100% GST/VAT (for customs) | 100% |

| V | Standard VAT (UK, Eurozone, South Africa, Nepal, Fiji) | |

| G | Standard GST (Australia, New Zealand, Singapore, Canada) | |

| * | MoneyWorks System code for transactions "outside of tax system" | 0% |

| Additional Canada GST Codes | ||

| H | Standard HST (rate varies by province) | |

| P | PST (rate varies by province) | |

| T | GST + PST (rate varies) | |

| Q | QST | 9.975% |

| Default Australian Codes | ||

| G | Standard GST | 10% |

| I | Input taxed | 0% |

| C | Capital acquisitions | 10% |

| F | GST-free | 0% |

| X | Exports | 0% |

| W | Salary and Wage Payments | 0% |

| P | Amounts withheld from wages | 0% |

| U | Amounts withheld where no ABN quoted | 48.5% |

| Additional UK Codes | ||

| VR | Reduced VAT | 5% |

| EU | Sales/Purchases made in Northern Ireland from EU Member States | 0% |

| Default Singapore Codes Note: Rates will increase to 8% on 1 Jan 2023 and 9% on 1 Jan 2024 | ||

| G | GST (SR/TX7) | 7% |

| E | Exempt (ES33/EP) | 0% |

| Z | Zero Rated (ZR/ZP) | 0% |

| A | GST on Imports (IM) | 100% |

| IM | Imported Goods | 7% |

| ME | Major Importes Scheme | 0% |

| BL | Not Claimable | 7% |

| NR | Non-registered | 0% |

| OP | Purchases outside GST Scope | 0% |

| E33 | Reg 33 Exempt Purchases | 7% |

| EN3 | Non Reg 33 Exempt Purchases | 7% |

| RE | Residual Input Tax | 7% |

| ESN | Non Reg 33 Exempt Sales | 0% |

| DS | Deemed Supplies | 7% |

| OS | Sales Outside GST Scope | 0% |

| IGD | Import Deferment(IGDS) | 7% |

| RCM | Reg 33 Exempt Sales Financial | 0% |

| GPG | SRCA-S Customer accounting supply made by the supplier | 0% |

| CAA | SRCA-C CA supply made by the customer on supplier's behalf | 100% |

| CAG | TXCA Std-rated purchase of prescribed gds subject to CA | 7% |

| LVRC | Claimable portion of low-value services subject to GST under reverse charge (Box 14) | - |

| LVRC- | Non-claimable portion of low-value services subject to GST under reverse charge (Box 14) | 0% |

| EMREM | Remote services supplied by electronic marketplace operator (Box 15) | 8% |

| LVRED | Imported low-value goods supplied (Box 16) | 8% |

| LVOWN | Own supply of imported low-value goods (Box 17) | 8% |

| USA Sales Taxes | ||

| STA | State Tax | |

| CIT | City Tax | |

| CTY | County Tax | |

| USE | Use Tax | |

| ZER | Zero Tax | |

| EXE | Exempt Tax | |

| TAX | Combined Tax (STA+CTY+CIT) | |

Note: The "*" tax code is used for accounts that are outside the tax system (such as bank accounts). If you use it on other accounts you will not be able to override it when entering a transaction involving those accounts.

To see the tax table:

- Choose Show>Tax Rates

The Tax Rates table will be displayed:

Note: You can only modify tax codes if you are the only user on the system. If there is more than one user, the Modify button will show as View.

Note: As well as managing the taxes through the Tax Rate screen, you can also import taxes to create new ones or update existing rates (see Importing Tax Rates).

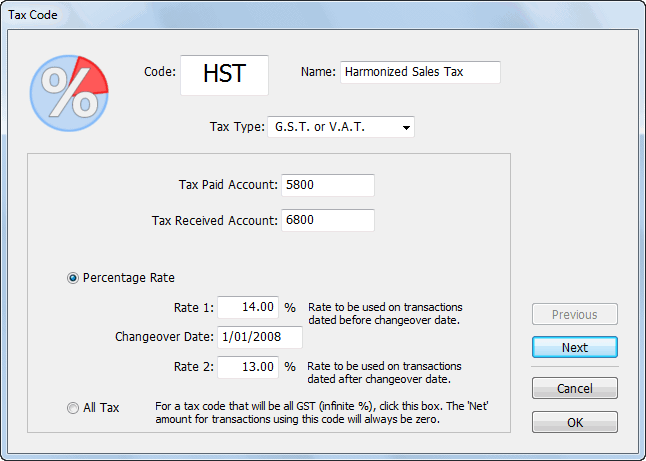

Adding a New Tax Code

- Click the New toolbar button or press Ctrl-N/⌘-N

The Tax Code entry window will be displayed.

Note: If you have multi-currency enabled in MoneyWorks Gold/Datacentre, an additional Tax code is for different country option is available. Turn this on only if you are setting up this code for a different country. See Paying GST/VAT in Multiple Countriesfor more information.

- Type the code that will identify the new rate into the Code field

This can be up to five characters long, and must not be already in use.

- Type a brief description of the rate in the Name field

- Set the Tax Type

A tax can be either GST or VAT1, a Sales Tax, a Composite Tax (a combination of other taxes), or a Reversed Tax (where the supplier is liable for the tax).

New tax rates need to be associated with accounts specifically set up to deal with the tax. Unless you have set up additional GST/TAX accounts in your Chart of Accounts you will only have access to the two standard system accounts that MoneyWorks automatically sets up.

- Enter the Tax control account codes for the accounts that handle incoming and (if required) outgoing Tax into the Tax Paid Account and Tax Received Account fields

Simply tabbing through the fields will automatically insert the default codes. If more than one code is available, tabbing through the fields will display the Account Choices list.

- Enter the tax rate into the Rate 2 field

Unless you know details of a change to the tax rate, leave the Changeover and Rate 1 fields as they are.

If the rate is for 100% Tax

You will normally never come across 100% Tax transactions unless you are an importer. In this case you may get a bill for Tax from Customs.

- Set the All GST/TAX radio button if this rate represents 100% GST

- Click OK to accept these entries

Clicking Cancel will put the dialog box away without storing any of the changes that you have made.

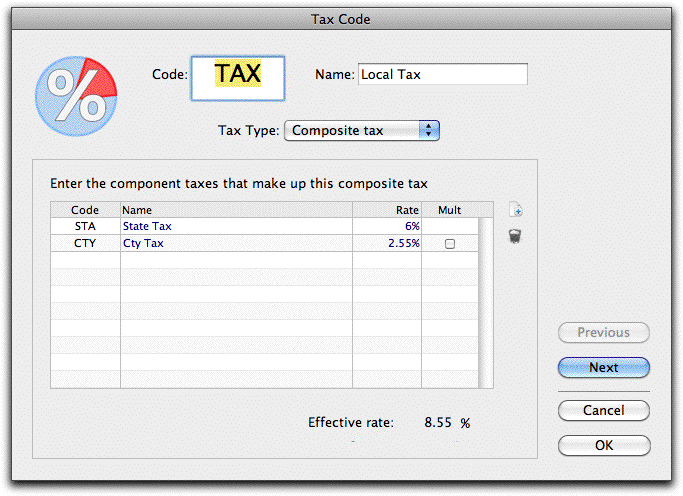

Composite Taxes

The Composite Tax option allows you to specify a tax that is calculated from other predefined taxes2.

To include a tax in the calculation:

- Click the New icon

A new line will be added

- Enter the code of the tax to include in the Code field

The name and rate will be displayed. Note that this must not be the code for another composite tax.

- If the tax is multiplicative (i.e. is also levied on the previous taxes in the composite tax calculation, such as QST in Quebec, or PST in PEI), set the Mult check box

If this is not set, the taxes will be simply added, i.e. each tax is calculated on the Net amount.

- To delete a tax from the calculation, click the Trash icon

When a composite tax is used in a transaction, an additional (hidden) detail line is added for each component tax used (unless the tax is a Sales Tax and has been “expensed” as part of a purchase).

There are some rules and restrictions for composite taxes:

- If a tax is based on a GST/VAT tax, these must be the first taxes in the calculation. For example, GST + PST is allowed, but PST + GST is not;

- A maximum of two GST/VAT taxes can be used in a composite tax;

- Composite taxes cannot be modified once they have been used. You can change the rate of the components, but not the structure itself;

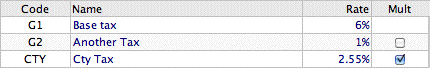

- Composite taxes are calculated strictly top-down. Thus:

is calculated as (G1 + G2) * CTY, and not as G1 + (G2 * CTY).

Note: MoneyWorks Express and MoneyWorks Gold let you create your own forms (invoices, statements etc). Special fields are available in your invoice design to isolate the GST and PST amounts:

- For the GST content on a transaction line use detail.tax1amt

- For the balance of the tax content on a transaction line use detail.tax2amt