MoneyWorks Manual

Purchasing Prescribed Goods

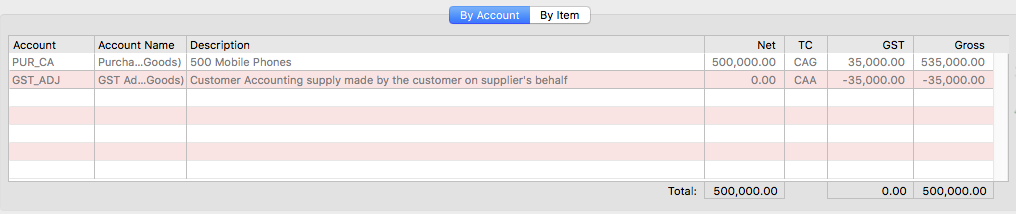

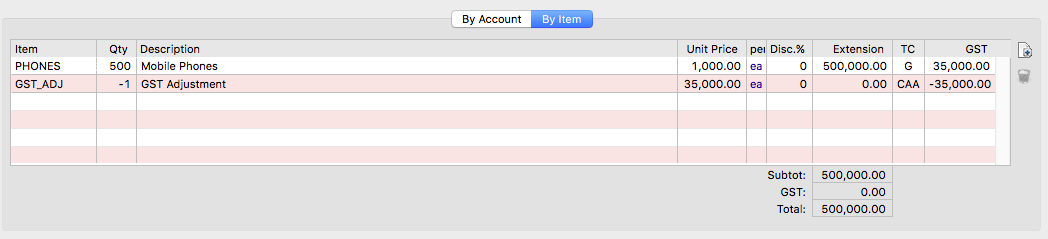

When you purchase prescribed goods you do not pay GST to the supplier, but rather you will be responsible for paying it to IRAS. For MoneyWorks to automatically do the GST accounting required, it is important that:

- The purchase line of the invoice has a tax code of CAG.

GST will be added to this line at the standard rate.

- The GST is netted of with a negative line with a tax code of CAA.

To achieve this use either the general ledger code or the item code created above (for By Account or By Item transactions respectively).

Thus a "By Account" purchase invoice will be coded in MoneyWorks as:

A "By Item" purchase invoice will be coded as:

Note that in the "By Item" example, you must enter the negative GST amount in the GST column for the GST Adjustment.

Tip: Put a sticky note on the items that you purchase as prescribed goods to remind you about the special coding required and the threshold.