MoneyWorks Manual

Accounting for GST, VAT or Sales Tax

If you are not registered for GST, VAT, PST or Sales Tax1, you will not want to have MoneyWorks keep track of GST for you. You should therefore turn off the option I need to account for GST.

If this option is off:

- The tax columns in the transaction entry will be hidden, and no GST will be accounted for when transactions are entered;

- You will be able to purge (i.e. delete) transactions that have not been processed in the GST report.

You can turn the option on later if required in the Document Preferences —see GST/VAT/Tax.

Note that even if this option is turned off, MoneyWorks will still create two GST control accounts. You cannot delete these accounts, and should not use them.

If you do account for GST/VAT/Sales Tax

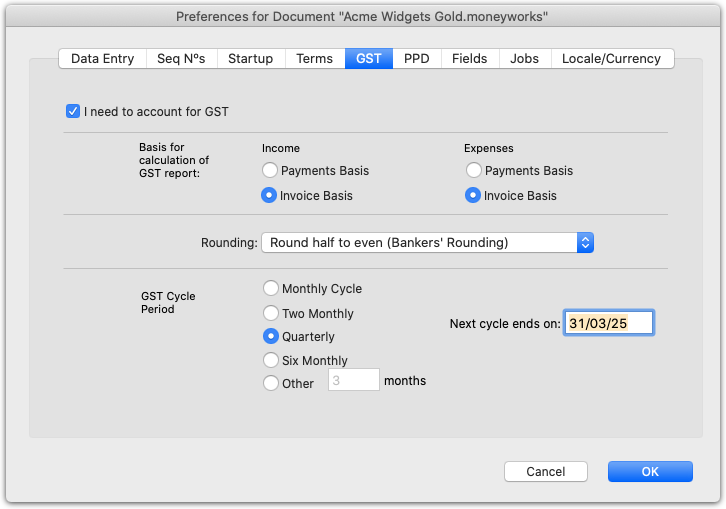

If, as is most common, you need to account for GST, you need to set up your GST details in Moneyworks. If you don’t know some of the details, you can set this up or change it later —see GST/VAT/Tax.

- Click the GST Setup button to display the GST Settings window

Set the options as appropriate for your GST basis, specifically:

- If your GST is done on a payments or cash basis, set the Payments Basis option; if it is done on an invoice or accrual basis, set the Invoice Basis option;

- Set the GST Cycle to the frequency with which you make your GST/BAS return to the government;

- Set the Next cycle ends on date to your Close-Off Date. This is because it is advisable to run a special GST report once the setup has been completed to mark the setup transactions as having been processed for GST.

Note: Any general ledger accounts with a "*" tax code are considered to be outside the tax system, and cannot have tax applied to them. Do not use this tax code for day to day accounts, such as sales, inventory or fixed assets.

For a discussion on GST, —see GST, VAT, Sales Tax & Tax Codes.

1 For simplicity, we will refer to VAT and Sales Tax as GST in the remainder of this chapter ↩