MoneyWorks Manual

Landing Costs

Landing costs are the costs incurred in transporting an item from the place of purchase to your premises. These might include freight, insurance, duties and more.

Landing costs should be included in the value of the stock; e.g. you might pay $100 to your supplier for an item, but it also costs a further $50 in freight. In this case the inventoried value of your item should be $150, not the $100 purchase price.

Once you have determined your landing costs for an order, it is relatively simple to spread them over your initial purchase order or supplier invoice. To do this we basically increase the total of each line item of the invoice by the additional landing costs (by using a negative discount), and we add a single offsetting line to the invoice that encompasses the landing cost.

For this to work, we need to create a new "product" to enter the landing costs; for example "LANDED". We will buy and sell this product (but will not stock it), and it will be associated with the landed costs expense account in your chart of accounts.

Example:

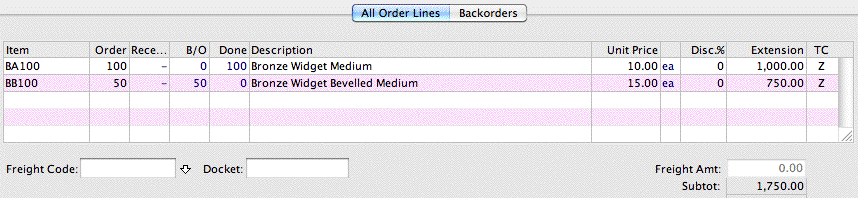

We have a purchase order with the following 2 items in it:

The total of the order is $1,750 (plus tax if applicable).

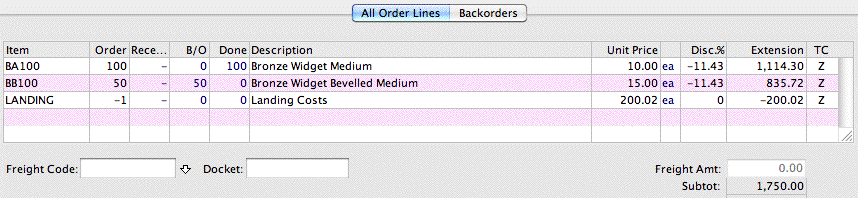

Assume that the landing costs (freight, duty etc) come to $200 (in practice these won't normally be known until the goods have arrived). Now $200 is 11.43% of the actual cost of the goods (200/1750 x 100), so we need to increase the value of each item by 11.43% when it comes into stock.

To do this we simply apply a NEGATIVE DISCOUNT of 11.43% to each line of the order, then add a new line to subtract the total landing cost so that the value of the order remains the same. The new line is entered with a quantity of minus one, and with the unit price set to that of the total landing cost (with no discount). Thus we would have:

Note that because of accumulated rounding error using the discount, we might have to adjust the value of the LANDING up or down a few cents (in this case to 200.02) to ensure the value of the order stays at the original order value. So in this example the order still has a value of $1750.

When this order is processed (and the resultant invoice posted), the buy price of the stock items will be set to the Unit Price (so that BA100 will have a buy price of $10), but each item will go into inventory at a value of 11.43% higher than the buy price (i.e. each of the new BA100 items will have a stock value of 11.143, which neatly incorporates the landing cost).

The actual invoice(s) from the shipping/custom agents for the freight, duty etc, get entered separately into MoneyWorks.You can code them to the LANDING product, or to more specific general ledger codes (which will be offset by the LANDING general ledger code).

Tip: You can have MoneyWorks calculate the discount for you by entering the formula directly into the discount field (for MoneyWorks to recognise a formula it must start with an “=”). In the example above we could have entered:

=-200/1750*100

into the discount field, and when we tabbed out MoneyWorks would have evaluated it and substituted the result as -11.4286. We could then have copied and pasted that value into the remaining discount fields.

Note: If your supplier is represented in MoneyWorks in one currency, and the landed costs in another, you need to convert the landed costs entered into the Purchase Order/Invoice into the currency of the Purchase Order/Invoice.