MoneyWorks Manual

WET Tax (Australia)

MoneyWorks will handle the Australian Wine Equalisation Tax (WET) tax, provided the Locale is set to Australia and a tax code of WET is correctly created.

Changes to the General Ledger for WET

It is a good idea to keep the WET collected separated from your normal GST. For this reason the first step in setting up to handle WET is to create three new tax accounts as follows:

- A new WET Tax Holding Account

This is a current liability account with a "*" tax code.

- A new WET Received Account

This is of type GST Received

- A new WET Paid account

This is of type GST Paid

Changes to the Tax Table

You will need two new taxes, one for WET (which you probably won't directly use), and a composite tax for "WET with GST lumped on top", which is the one you will use.

In Show>Tax Rates:

- Create a new tax with a code of WET (it must be a code of WET)

The TAX Paid and Received accounts should be the new WET Paid and Received accounts as created above.

The current percentage is 29%.

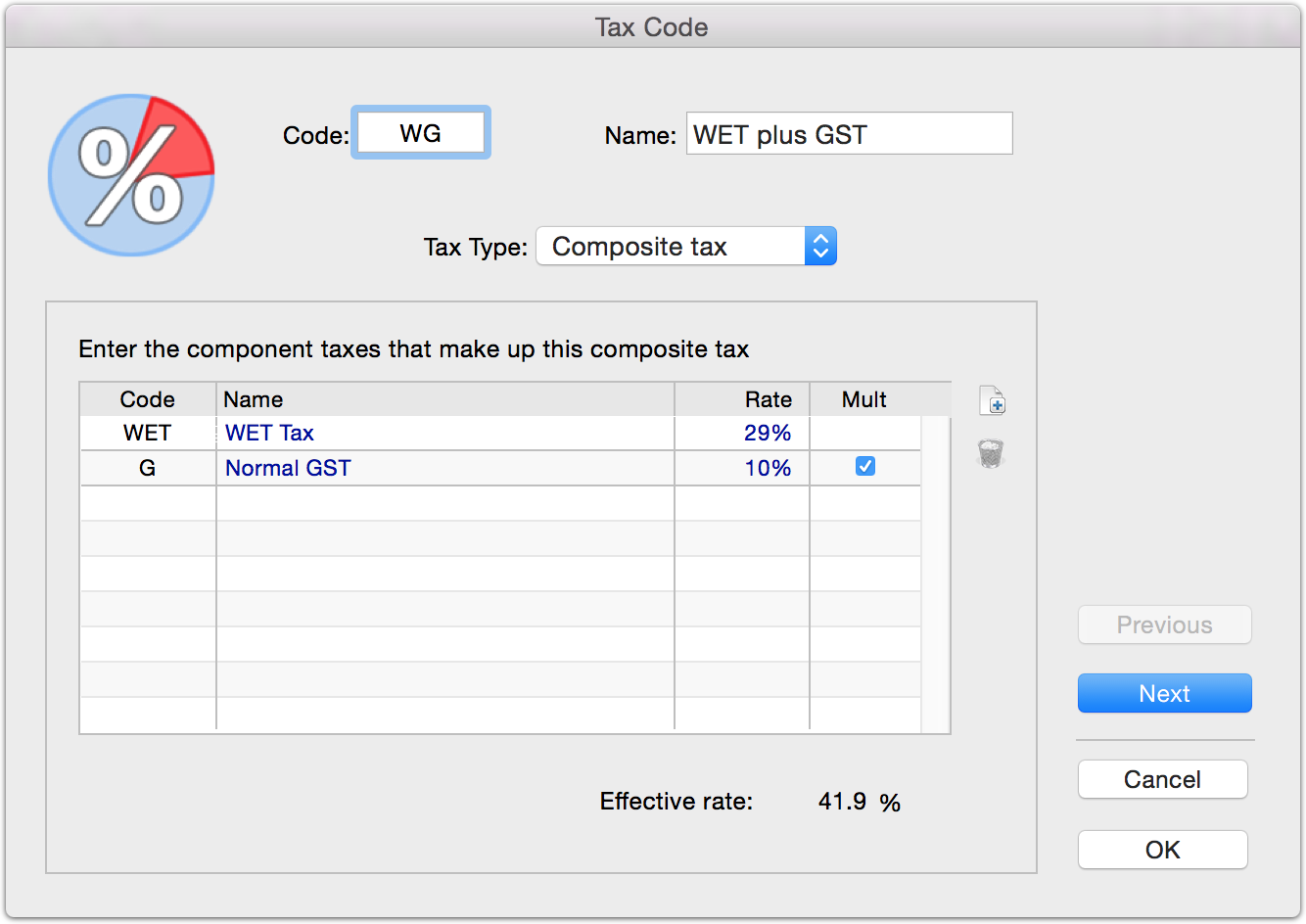

- Create another new tax code WG

This is because GST is applied on top of WET.

This is a "composite tax". The first tax must be WET, with the second being your normal GST code (normally G, but you might have used something else). Make sure the Mult (multiplicative) check box is set (otherwise the taxes will be added, which is wrong).

Accounts for handling sales and purchases involving WET

You should create new General Ledger accounts to account for transactions that use the WET tax.

You will need one for Sales, one for Cost of Sales, and, if you are running inventory on items subject to WET, one for Stock.

The tax code on these accounts must be set to WG (not WET, as you will be paying WET with GST on top).

Create the new products

Assign the income, expense and stock accounts to the appropriate ledger accounts that are set to GW.

Special Requirements for Invoice

You will need to format your invoice to show the WET at the bottom. The Traditional Invoice form does this, or you can modify your existing invoice layout.

GST Report and WET

When the WET tax is correctly set up, a second column will appear in the GST Report which lists the WET tax on each transaction. This is summarised at the bottom, the same as for other tax rates.

When the report is finalised, an additional field is available for the WET holding account (which is where your WET tax will be journalled into). Enter the code of the previously created WET Holding Account into this.

The BAS Guide will configure to show the WET in the appropriate boxes.