MoneyWorks Manual

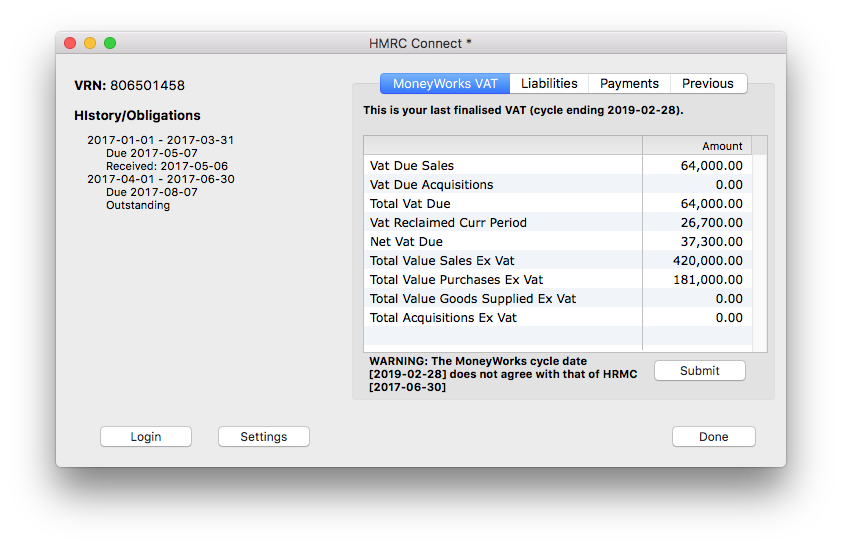

HMRC Connect window

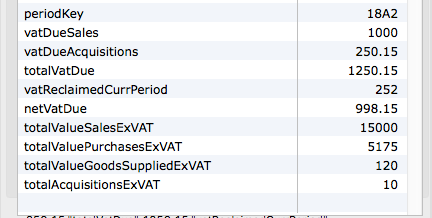

Information about your latest VAT information, as well as information accessed from the HMRC site, is displayed in this window:

VRN Number: This is the VAT number as specified in Show>Company Details in MoneyWorks.

History/Obligations: This information is retrieved from the HMRC site and shows your history and obligations over the last twelve months.

MoneyWorks VAT: These are the numbers from your last Finalised VAT return in MoneyWorks. It is these numbers that will be uploaded to HMRC if you click the Submit button.

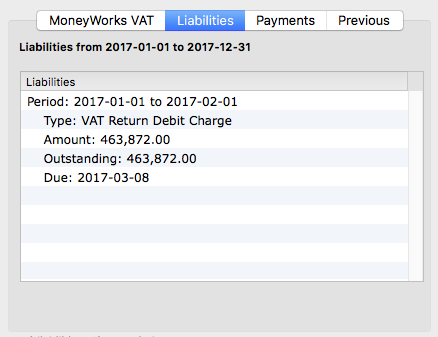

Liabilities: Click on this tab to display your current VAT liabilities as recorded by HMRC. Note that there will be a delay of a few seconds while MoneyWorks retrieves the data from HMRC.

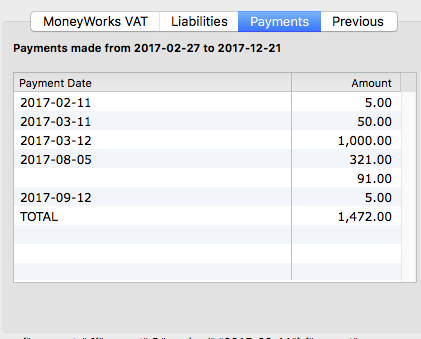

Payments: Click on this tab to see your payments as recorded by HMRC. Note that there will be a delay of a few seconds while MoneyWorks retrieves the data from HMRC.

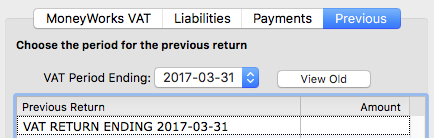

Previous: Click on this tab to view a previous VAT return. Select the VAT period from the Period pop-up menu and click the View Old button.

Note that there will be a delay of a few seconds while MoneyWorks retrieves the data from HMRC. The information from the selected submission (if any) will be displayed in the list.

Login: Click this button only if you need to force a re-login to the HMRC system again. MoneyWorks will automatically log you in whenever you choose Command>HMRC Connect, but there may be circumstances when you want to force a new login.

Note: MoneyWorks will preserve the login information (a token supplied by HMRC when you first successfully login) across sessions. Clicking this Login button will clear this token, and you will need to re-enter your HMRC Credentials.