MoneyWorks Manual

Anatomy of the GST Report

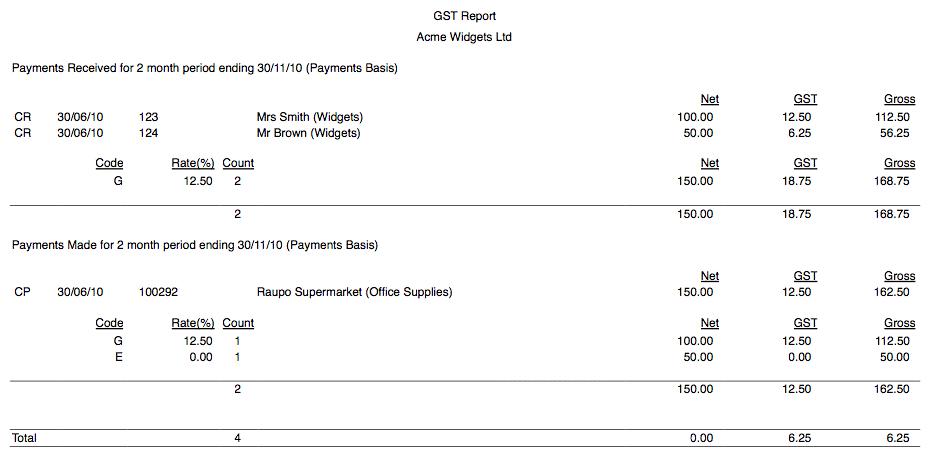

The first part of the report deals with receipts made by you during the GST period—the GST component of these must be paid to the government. The second part of the report deals with payments made by you—the GST component of these can be claimed back. It is therefore the difference between these amounts that you need to pay or claim—this is shown in the Total line at the bottom of the report.

Note: Canadian users will get a report detailing both GST and PST/QST. For QST, just use the figures from the report; for PST, you should only use the GST column for the GST, and run the Sales Tax report for the PST

If you have entered your transactions correctly and not overridden any of the GST fields the following should apply:

- The Z, E, F, I and * tax codes should have 0 in the GST column (they won’t be shown if you haven’t used any accounts that use them).

- The amount of GST for the other tax codes divided by the GST rate (currently 10.0% for the G and C tax code in Australia, 15% for the G code in New Zealand) should equal the Net. Do not worry if it is a few cents out—this is rounding error due to GST amounts of less than 1 cent.

The report operates on the following principles.

- All Posted transactions in the system that occurred on or before the GST Cycle Date and have not previously been processed for GST will be included in the report

- This means that the GST cycle is totally independent of your normal financial period structure. It also means that any transactions that need to be posted into periods already processed for GST will be handled correctly in the next GST report.

- The GST Cycle Date is set in the Preferences dialog. It is automatically maintained by MoneyWorks, and is updated when you Finalise your GST report—you can change it if it is wrong.

The processing of the transactions varies depending upon whether you are operating on a cash/payments basis or an invoice/accrual basis. You may need to talk to your accountant to determine which you are on.

Payments/Cash Basis: All eligible cash payments and receipts are processed, as well as any zero value invoices1. The GST is determined from the tax code of each detail line in each cash transaction. The amount of GST is as recorded in the GST column of the detail line.

If the payment or receipt relates to an invoice, the GST in the detail lines of the invoice are used. Partial payments on invoices are pro-rated.

Invoice/Accruals Basis: All eligible cash payments and cash receipts that are not part of the debtors and creditors system are processed as for cash payments above. All eligible invoices received and sent are similarly processed.

Journals: It is not possible to determine whether a journal entry that involves a GST account should be included in the GST report or not. Therefore any journals that involve the GST accounts will be summarised at the end of the report (or listed if the Show Transactions option is on). You will need to manually adjust the return if any of these need to be included. It is for this reason that we recommend that you do not journal through corrections to transactions involving GST: instead cancel the original transaction, and then create a new corrected one.

Partial payments of invoices: If operating on a payments basis, the amount of the partial payment is pro-rated across the invoice to determine the GST.

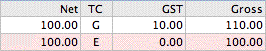

As an example, consider that you have received an invoice for $210 similar to that shown at right.

For some reason you paid only 50% of the invoice, i.e. $105. Of this amount, $5.00 is considered to be GST, being half of the total GST. If you decided to pay the non-taxable portion and not the taxable (i.e. $100 only), MoneyWorks would assume that you had paid 100/210.00 of the entire transaction and calculate GST accordingly at:

100/210*10%=$4.76.

This does not arise on an accrual/invoice basis: all the GST is claimable.

Overpayment by a Debtor: If a debtor overpays his invoices (perhaps he paid one twice by mistake), the overpayment cannot be allocated to any particular invoice. Nor are there any supporting Tax Invoices for the overpayment. Therefore it is considered to contain no GST.

If the overpayment is allocated to the Debtor’s account (so he has surplus funds), and is subsequently used to pay off an invoice, the GST is calculated at that point. However if the amount overpaid is returned to the debtor, no Tax Invoice is generated and hence there is considered to be no GST in the repayment. This applies whether operating on an invoice or cash basis.

Purging Transactions: Transactions which have not been processed for GST will not be purged if you purge the period containing them (unless the I need to Account for GST preference option is off).

1 A 100% deposit on an order for example will generate a zero valued invoice when the items are shipped. These will affect on your GST if the deposit was coded to an exempt GST account. ↩