MoneyWorks Manual

Entering Detail Lines by Account

Using the By Account, method of detail line entry allows you to specify the account (and department, for departmentalised accounts), and, if necessary, override the default tax code for the account or even the actual tax amount.

- Enter the account code into the Account field and press tab

If the account has departments (MoneyWorks Gold), you must also include the department code after the account code. For example:“1000-JK” for account “1000”, department “JK”.

If the transaction is a Payment or a Creditor Invoice, this account will be debited by the net amount that you enter on this detail line. If the Transaction is a Receipt or a Debtor Invoice, this amount will be credited by the net amount that you enter on this detail line.

When you press the Tab key, the account name and tax rate will be entered for you.

If you leave the account field blank, or type an incorrect or incomplete one, the account choices window will open —see Entry and Validation where a Code is Required. Select the account you require by double-clicking on it.

If the account has a Sticky Note associated with it that is applicable to this type of transaction, the note will be displayed when you exit the field.

Detail Description

- Enter a description for the monies pertaining to this account into the Description field

The description can be up to 1000 characters. If you need to start a new line (i.e. insert a “carriage return”), press Ctrl-↩/Option-Return1. If you run out of space click on the down arrow icon or press Ctrl-↓/⌘-↓ to open a separate window for typing the text.

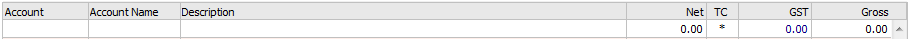

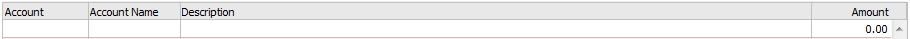

If the I need to Account for GST/VAT/Tax preference option is on, there will be separate columns for entering the Net, GST and Gross amounts for each detail line. If the option is off MoneyWorks will not monitor Tax and only a single Amount column will be displayed.

When the I need to Account for GST/VAT/Tax preferences option is on, columns are displayed in each detail line that allow you to enter either the Tax exclusive amount (Net) or the Tax inclusive amount (Gross)

When the I need to Account for GST/VAT/Tax preferences option is off, a single column (Amount) is displayed, and no calculations are done for tax.

- Click or tab into either the Gross or the Net fields and enter the amount to be debited or credited to the account

If you enter the net amount, the Tax and gross will be calculated. If you enter the gross amount, the net and Tax are calculated automatically.

If the Auto-Calculate Transaction Total option in the Data Entry preferences is set, the sum of the amounts in the Gross column will be entered into the transaction Gross field for you. This is the default for cash receipts and debtor invoices.

Changing the GST/VAT/Tax

If the Tax for this part of the transaction is different from that calculated using the default tax code for the account, you can overtype either the tax code (which will cause the Tax amount to be recalculated using the net amount and new tax code) or the Tax amount itself. If the Tax on a purchase bears no apparent relationship to the codes, US and Canadian users can override the total transaction tax.

Note: MoneyWorks will display a warning if you alter the amount in the Tax field. It is only on rare occasions that you will need to do this, as for example if the Tax rounding on an invoice is different.2

Canadian GST and PST: The aggregate GST and PST for the line is shown in the Tax column. These are shown separately when you print the GST Report.

If the Show Job Column option is set in the Jobs preferences, you can also specify the job (if any) to which the detail line refers —see Automatic Entry from the Transaction File.

- If you need to allocate the remaining amount of the transaction to further accounts, make a new detail line by:

pressing ↩/Return or;

pressing Ctrl-N/⌘-N or;

clicking the New Detail line icon or;

tabbing through the remaining fields on the current line, but only if the Auto Wrap option is off.

Pressing ↩/Return when you are on the last detail line will cause a new detail line to be added. If the insertion point is not on the last detail line when you press ↩/return, the insertion point merely moves to the Account field on the detail below the one you were on.

1 The exact key combination depends on the settings in your Key preferences). ↩

2 By default, MoneyWorks uses Banker’s Rounding when rounding amounts to the nearest cent. This means that the value is rounded to the nearest even number, thus reducing the accumulated rounding error. It is also known as “Gaussian rounding”, and, in German, “mathematische Rundung”. The rounding method can be changed in the GST/VAT/Tax settings tab of the Document Preferences. ↩