MoneyWorks Manual

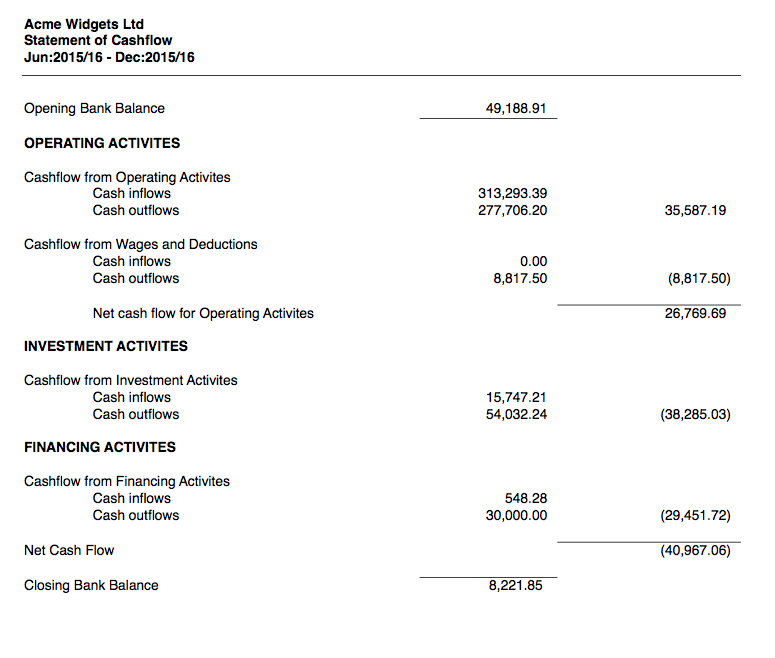

Statement of Cash Flows

This produces a statement of cash flows (in local currency) divided into Operating, Investment and Financing activities.

The report is calculated using the direct method, i.e. the general ledger codes that each cash transactions is coded to is inspected to determine whether it is Operating, Investment or Financing. For payments or receipts against invoices, the originating invoice's coding is used.

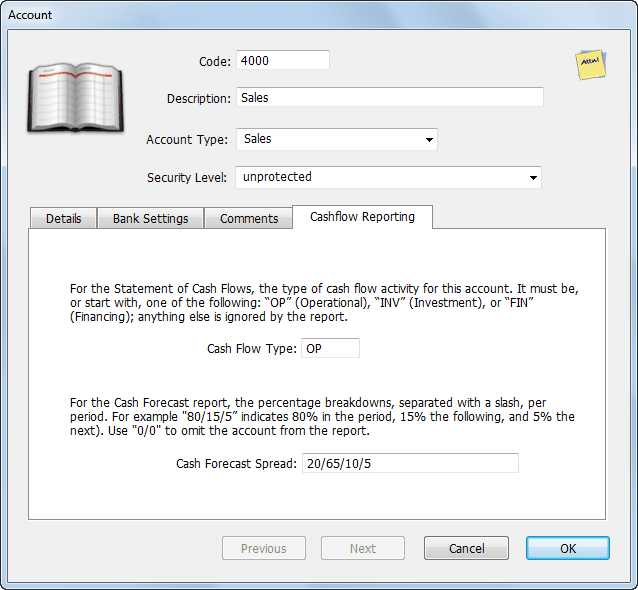

Whether an account code is Operating, Investment or Financing is determined by the setting in the Cash Flow Type field on the Cashflow Reporting tab on the account record:

Operational: The setting must be, or start with, "OP"

Investment: The setting must be, or start with, "INV"

Financing: The setting must be, or start with , "FIN"

Any other settings will be ignored (so the account will not appear in the report, probably giving rise to an imbalance).

More detailed Statement of Cash Flows

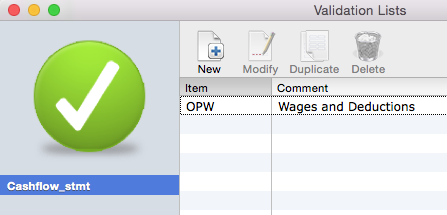

It is possible to break the report down into "categories" of cash flow within the main Operating, Investment, or Financing areas. This is shown in the sample above where there is a section "Cashflow for Wages and Deductions".

To do this simply use any code starting with "OP" or "FIN" or "INV" (depending on which segment of the report it should be in). The example above was generated by assigning "OPW" to the cash flow setting for all the wage and deduction general ledger accounts. For reporting clarity, a label can be assigned to these additional codes using a special validation list named "Cashflow_Stmt", as shown.

Note that the segments are printed in alphabetic order of the code used (so "OPW" will print after "OP" and "OPA").

Journal handling for Statement of Cash Flows

The statement of cashflow will also consider well-constructed journals against bank accounts. "Well constructed" in this context is a journal that contains a single bank account line (either as a debit, for inwards cash, or a credit, for outwards cash), and all other lines are on the "other side" of the journal (i.e. all credits and debits respectively). If the report does not balance, a list of journals that are not "well constructed" is appended to the report.

Foreign currency gain/loss journals are also included to account for realised gains/losses.

You can also force other journals to be included by having the text "CashFlow" in the Analysis field of the journal. You would do this if you have used a journal to correct a previous cash transaction. The cash flow is deemed to take place in the period of the journal, and credits will be treated as inwards cash.