MoneyWorks Manual

Cash Projection Report

The Cash Projection report prints a report of your expected short term cash flow based on posted recurring transactions and outstanding invoices. The report is presented as a running bank balance (based on current asset bank accounts), with an optional daily chart available.

The report always starts on the current date, and you specify the number of days into the future to print the projection for. Bear in mind that it is not really practical to try to project more than about 30 days into the future (for a longer term forecast, use the Cash Forecast report).

If you have overdue invoices, they will appear on the report as receipts/payments at the end of the following month, unless they are explicitly excluded by one of the Ignore Old report options.

Payments and receipts that are specially marked by a value of “R/n” in the analysis field will also be included. The value of n is used to indicate the number of days between recurrences (e.g. a value of R/14 will recur every two weeks). Provided the first recurrence will be after today, the transactions will appear in the report as recurring payments/receipts. This allows you to include the effect of non-recurring but regular transactions, for example payroll transactions imported from an external payroll system. These transactions are included regardless of whether they are posted or not.

Note: Transactions that have a value of “R/0” in the analysis field will be omitted. This allows you to specifically exclude selected invoices, recurring transactions or GST/VAT/Tax journals from the projection.

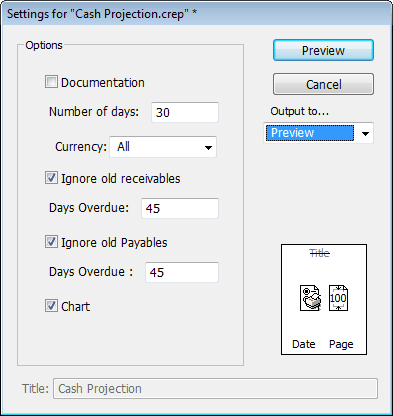

Number of days: The number of days to project into the future.

Currency: The report can be run for all currencies, or just a nominated one. When run for all currencies, today’s system exchange rate is used to convert the balances of foreign currency bank accounts and transactions to the local currency. When run for a selected currency, only bank balances and transactions in that currency are included (and the report is printed in the selected currency).

Ignore Old Receivables: Turn this on to omit sales invoices that are already more than a the specified number of Days Overdue on the grounds that you are not really sure when (or if) they will be paid.

Ignore Old Payables: Turn this on to omit purchase invoices that are already more than a the specified number of Days Overdue.

Chart: Append a chart of the projected future bank balances.

Note that if there is a GST/VAT/Tax journal present less than 20 days old (provided it does not have a value of “R/0” in its analysis field), a payment, dated twenty days after the journal date, will be included to account for the expected tax payment. No allowance is made for refunds.