MoneyWorks Manual

GST/VAT/Tax

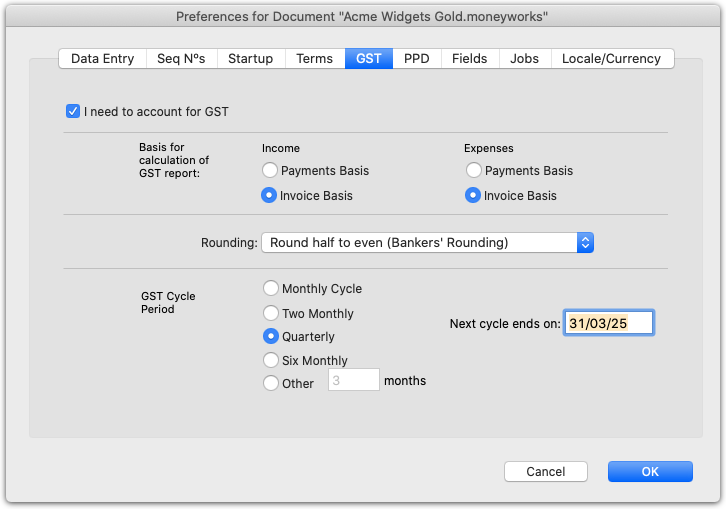

These preferences determine if you want MoneyWorks to track your GST/VAT or Sales Tax, and (for GST and VAT), the length of your GST/VAT cycle—this is required for the GST Report (but not for Sales Tax reporting, which is normally done using the Sales Tax report). Before you print your first GST/VAT report, you will need to specify the end date for your first GST/VAT cycle. Thereafter, MoneyWorks will recalculate the next cycle end date using the cycle length specified.

Note: MoneyWorks Cashbook only supports GST on a payments/cash basis.

For an outline of the way in which these settings are used to generate your GST/VAT returns —see GST, VAT, Sales Tax & Tax Codes.

I need to account for GST/VAT/TAX This option must be on if MoneyWorks is to track your Tax. If it is not set no Tax tracking will be done—the Net, TC and Tax fields in the detail lines of transaction entry will be replaced by a single Amount field.

Income Click Payments or Invoice Basis to indicate whether GST on your income is payable on invoice (accruals basis) or when the payment is received (cash basis).

Expenses Click Payments or Invoice Basis to indicate whether GST on your expenses is payable on receipt of invoice (accruals basis) or when the payment is made (cash basis).

Rounding Defines how half cents should be rounded. The choices are Bankers' Rounding (round-half-to-even) which will round half cents towards an even number; or Round Away From Zero which will round half cents "upwards" (actually downwards when negative). Documents created in MoneyWorks versions before 9.0.2 will have Bankers' rounding set by default. New documents created with 9.0.2 and later will default to Round Away From Zero.

GST Cycle Click the radio button to identify your GST return cycle frequency.

Next Cycle ends on Enter the last date of the next Return cycle into the edit box. This date is used to identify the transactions to be processed for the GST/VAT return.