MoneyWorks Manual

Filling out your GST Return

The GST Report provides a definitive audit trail of how your GST is calculated—this is handy for your accountant or any itinerant tax inspectors who may drop by, but is not in a form that can be used as part of your return.

The GST Guide Form will provide information from the GST Report in a form suitable for transcribing to your GST Return or BAS. This prints details from the last finalised GST Return (but is not available for all countries).

Journalling Out the GST Accounts

When you have finalised your GST return, the GST control accounts should be cleared by means of a journal. This journal will be created and posted for you automatically if you set the Journal to GST Holding Account option when you finalise your return.

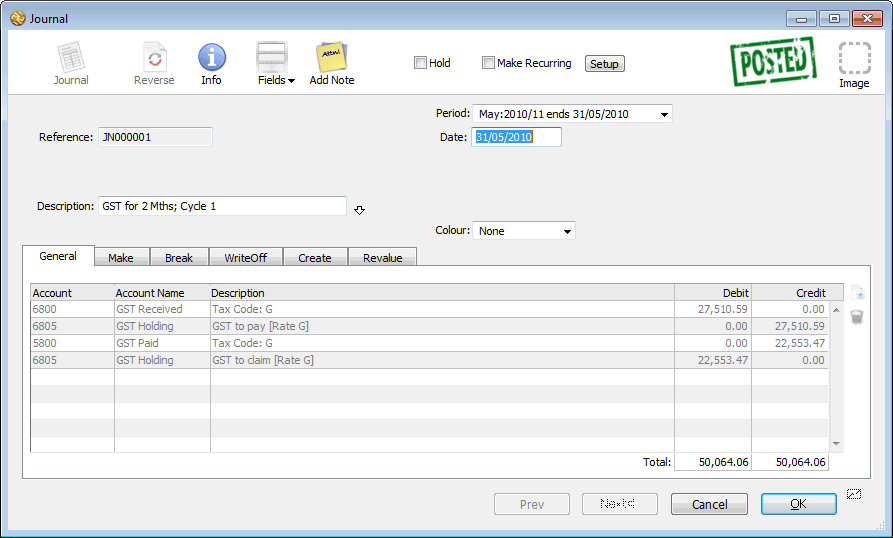

If you choose to create it manually, the journal should be made out as follows see General Ledger Journals for information on creating journals:

- It should have the same date (and hence the same period) as the end of the GST Cycle

- The total GST received as listed in the report should be debited against the GST Received control account

- The total GST paid as listed in the report should be credited against the GST Paid control account.

- The difference between these is the amount of GST that you owe or will receive as a refund. You need to enter this in (as either a credit if you owe it or a debit if it is a refund, whatever balances the journal) against a GST Holding account.

The GST Holding is a normal Current Liability account (i.e. it is not set up as one of the special GST system accounts). It should have a tax code of “*”.

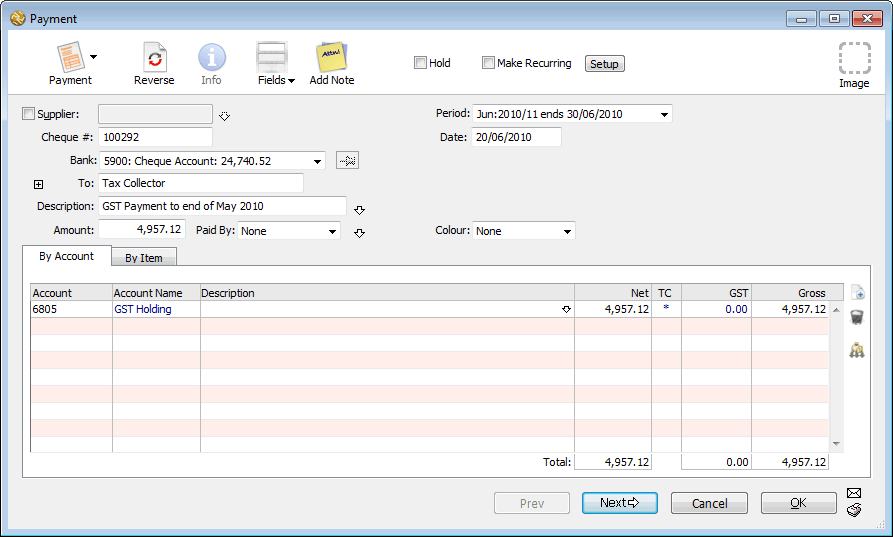

Paying your GST

Some time after your GST cycle end date, you will need to pay your GST to the Government—this varies from country to country. Do this using a normal payment transaction, with a single detail line containing the GST Holding code and the amount that was journalled in to this. When this transaction is posted, the balance in the GST Holding account should be zero.

Receiving a GST Refund

If you are in the happy position of actually receiving a refund for GST, you should process the cheque when it arrives as a cash receipt transaction. It should be coded to the GST Holding account, and again, after the transaction has been posted, the balance in this account should be zero.