MoneyWorks Manual

Determining the GST/VAT Liability

For your GST/VAT in your home country, you will keep finalising the GST/VAT report as usual.

However this probably will not work for other jurisdictions because the time interval might be different, or you might be on a different reporting basis (cash/payments versus invoice/accrual). In the case of our previous example, GST filing is every two months in New Zealand and every quarter in Australia. Further you might be on an invoice basis in New Zealand, but a cash basis in Australia.

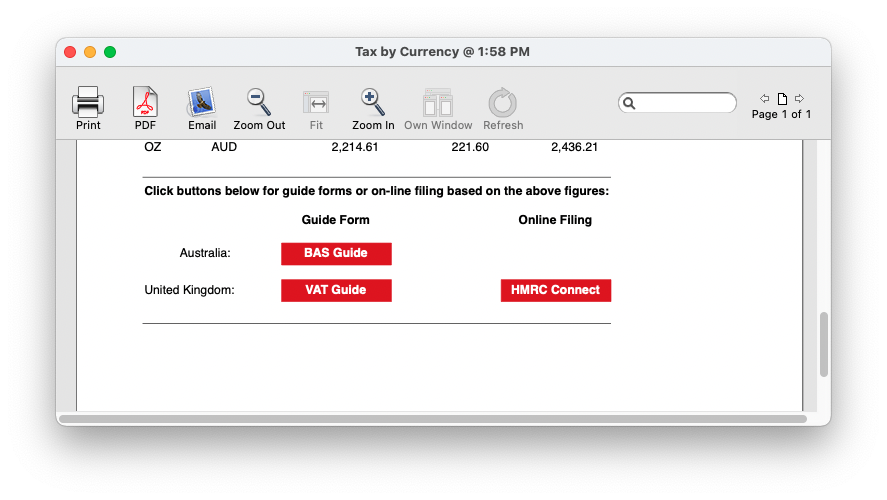

For other jurisdictions use the Audit>Tax by Currency report. This summarises GST/VAT for a period range on either cash or invoice basis. The results are cached and will be used automatically when you run one of the built-in MoneyWorks guides or on-line filing. There are buttons at the end of the report so the applicable guides and on-line filing can be accessed directly from the Preview window: