MoneyWorks Manual

Handling Overpayments

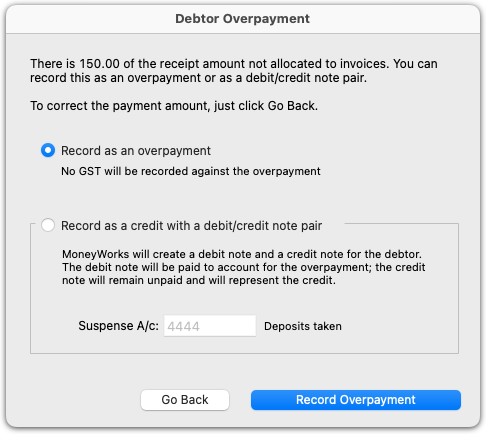

If a debtor overpays—that is, sends you a payment for more than the total of their outstanding invoices—you will not be able to allocate the whole amount to the invoices. In this case, MoneyWorks will ask you if you want to credit the debtor’s account with the amount by which they have overpaid.

In MoneyWorks 9.1.5 and later, there are two ways of doing this:

Simply credit the account and hold the amount for later allocation. No GST/VAT is calculated on the overpayment using this method. This is the method MoneyWorks has used for debtor overpayments since 1992.

Or, you can have MoneyWorks create a debit note/credit note pair for the amount and use the receipt to pay the debit note, leaving the credit note outstanding. Using this method, GST/VAT will be calculated according to the tax code of the suspense account you nominate.

If the amount by which the debtor has overpaid is slight (a few cents, say), you may want to use the write-off feature to “forget” the overpayment— see Write Off Option.

If you want the debtor's account to be credited for later allocation to an invoice, select the Record as an overpayment radio button, and then click the Record Overpayment button if. No GST/VAT will be calculated on the overpaid amount.

If you want to record the credit as a credit note (and a paid debit note), select the Record as a credit with a debit/credit note pair radio button, enter a suspense account to use on the debit/credit note. GST/VAT will be calculated according to the tax code for the suspense account. Then click the Record Credit button.

If you have made a mistake and want to correct the details of the receipt, click Go Back.

Since, when receipts are processed, the Accounts Receivable account for the debtor is credited by the full amount of the receipt (not just the amount allocated), the overpayment will appear on your balance sheet as a liability—that is, a credit to the Accounts Receivable account.

If the debtor has overpaid in error, and you want to send back the difference, use the Return Refund To Debtor command. This can be used with either type of overpayment credit.

If a debtor has an overpayment credit (as opposed to a credit note) recorded against them, you will be alerted the next time you process a receipt for that debtor. At that stage you will have the choice of allocating the existing overpayment or a new payment received.

If they have a credit note, that will appear in the list of outstanding invoices to be paid the next time you enter a receipt.